Merchant Accounts

- Home

- Our Services

- Merchant Accounts

Invest in Success: Harness Our Trustworthy Merchant Account Solutions Now!

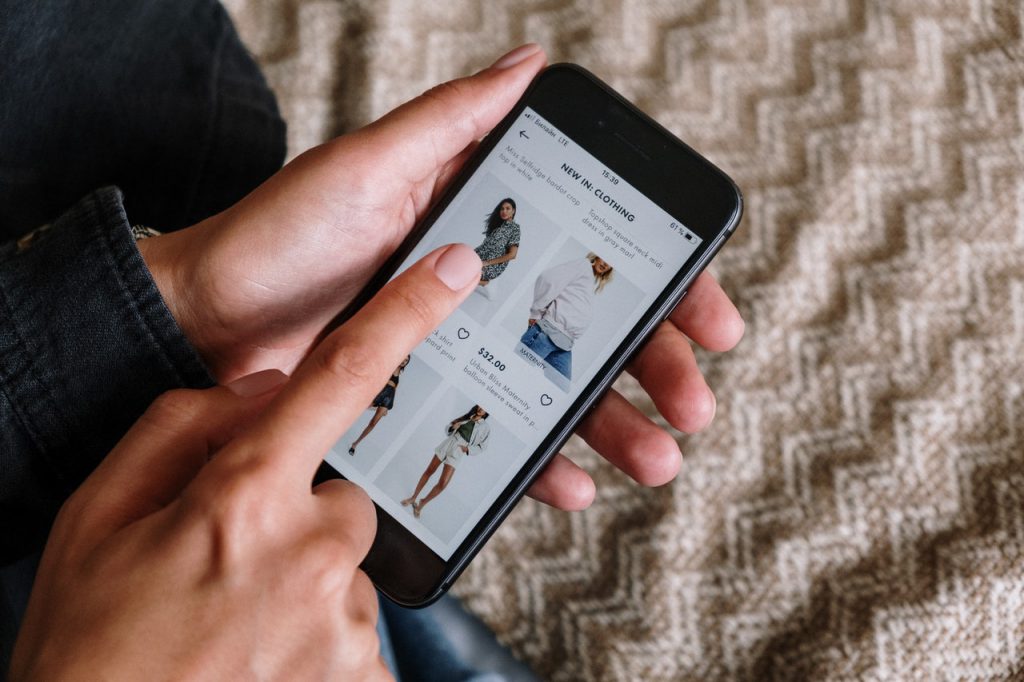

In the contemporary landscape, the conventional sight of customers laden with bulging wallets of cash or safeguarding cheque books in their purses has become a rarity. Debit and credit cards have solidified their status as the predominant payment modes within the vast spectrum of business transactions. Neglecting to incorporate credit and debit card acceptance into your business operations could translate into a significant loss of potential clientele. The intrinsic importance of accommodating card payments for businesses is undeniable. However, this pivotal transition does not occur in isolation; it necessitates the establishment of a merchant account, serving as a vital intermediary linking a customer's bank account with your business's financial domain.

A business needs a merchant account for several compelling reasons:

1. Accepting Electronic Payments:*In today’s digital age, customers predominantly prefer using credit and debit cards for transactions. By having a merchant account, a business can efficiently process these electronic payments, making it convenient and accommodating for customers.

2. Broadened Customer Base: Not everyone carries cash nowadays, and restricting payment options to cash-only can alienate potential customers. With a merchant account, businesses can cater to a wider audience, including those who prefer the ease and security of card payments.

3. Online Commerce: E-commerce has become a significant avenue for business growth. A merchant account is essential for processing online payments, enabling businesses to thrive in the global marketplace.

4. Enhanced Credibility: Offering card payment options signals professionalism and modernity. It boosts the business’s credibility, making customers feel more secure about their transactions.

5. Efficiency and Speed: Card payments are faster and more efficient than cash transactions. They reduce waiting times at checkout and streamline overall business operations.

6. Record-Keeping: Merchant accounts often come with built-in reporting and tracking features. This helps businesses keep accurate records of transactions, making accounting and financial management more organized.

7. Customer Convenience: Providing convenient payment methods enhances customer satisfaction. A merchant account caters to customer preferences, encouraging repeat business and positive reviews.

8. Higher Average Transaction Value: Studies show that customers tend to spend more when paying with cards than with cash. Accepting cards can thus lead to higher average transaction values for businesses.

9. Competitive Edge: In a competitive market, businesses that offer a variety of payment options have an edge over those with limited methods. A merchant account helps businesses stay competitive and relevant.

10. Safety and Security: Card payments offer a higher level of security compared to cash. Merchants can reduce risks associated with handling large amounts of cash on-site.

11. Scalability: As businesses grow, their payment processing needs also evolve. A merchant account is scalable and adaptable to changing business requirements.

12. Customer Loyalty Programs: Merchant accounts can facilitate customer loyalty programs, reward systems, and other incentives that boost customer retention and engagement.

In essence, a merchant account is not just a practical necessity but also a strategic asset that positions businesses for growth, customer satisfaction, and operational efficiency in the modern commerce landscape

Top features of We Tranxact Merchant Account that you can benefit from –

We Tranxact is committed to delivering a wide selection of services so that you can run your online store easily. Here are some of the prevalent features you can expect to receive through the We Tranxact Merchant account in the UK –

what documents are typically required for setting up a merchant account. This is not an exhaustive list:

To complete the merchant account application, you will require submitting documents like –

- Proof of photo ID - passport or/and drivers license

- Proof of home address

- Proof of business incorporation

- proof of business address

- proof of business banking

Credit card terminals

In this case, a customer not present merchant account will be provided to you. We have a range of card readers and card terminals to suit your needs.

Point of sale systems

Point-of-sale systems differ from payment processing hardware and card terminals. Point-of-sale systems combine your card terminal’s functions with computer software. POS software then helps in managing things like analytics and inventory.

From monitoring the sales to gathering tax purpose information, etc., this system helps can assist with a lot of things. In fact, many POS systems have a few add-ons, such as dedicated scanners and even receipt printers.

payment Gateway

Payment gateways are responsible for capturing your customers card details and billing address information, encrypting the card details, sending it through securely through the cards network, onto the merchant bank, who do all the necessary checks on the customers accounts to check if they have enough funds in their accounts and to verify that its actually coming from the correct source and all this happens in real time.

Virtual terminals

A software solution delivers through the cloud; a virtual terminal helps in turning smart devices and computer systems into a mobile POS system. You can either use USB connected card reader or enter the transaction manually into the system.

If you frequently visit festivals or prefer pop-up shops for selling products, then We Tranxact virtual terminals can prove highly useful.

Merchant cash advances

Are you in need of extra funds to start your business? We Tranxact can help!

We can provide you with access to extra cash. Until the repayment of what you owe is done to us, you can give a portion of your earnings to us.

Also, keep in mind Merchant advances vary immensely from normal loans because there isn’t a set amount that you are required to pay back.

Quality Advisory Services

We Tranxact Merchant account act as a dedicated consultant. As a result, we help align your needs with the right credit card companies. As an independent payments consultancy practice, our customers leverage our vast experience in the card processing and payments domain. As a result, we can act as the hub to get a custom-fitted solution depending on the industry, transaction type, and type of credit cards.

100% custom solutions to match your distinct needs

With We Tranxact, you get varied options in commercial arrangements with our partners. This way, as our client, you obtain the ideal card processing packages that meet your specific retail business needs. You can get the best card processing packages on variables like technology, service, cost, and compliance.

From low-risk accounts to high-risk accounts, we deliver services to all –

We Tranxact is committed to delivering a wide selection of services so that you can run your online store easily. Here are some of the prevalent features you can expect to receive through the We Tranxact Merchant account in the UK –

Low-risk merchant accounts

If your business is classified as a “low risk” business, We Tranxact can offer excellent merchant account services.

We understand that you may already have an online transaction in place and may require versatile account solutions. Hence we bring you the same. In fact, at lower card processing rates.

Who do we serve? From online ecommerce websites, trade shows, retail businesses, mail orders, phone orders, internet sales and so on!

High-risk merchant accounts

We Tranxact can also assist businesses classified as “high risk,” meaning merchant accounts that fall under industries like –

- International call centres

- Pre-paid phone cards

- Online tobacco

- MOTO

- Pre-paid phone card

- VOIP

- E-wallet/E-cash

- Online dating

- Nutraceutical

- Vape, etc.

Offshore merchant accounts

Is your domestic bank unable to offer your offshore business a reliable processing solution? We Tranxact has got your back!

Our offshore processing suits businesses with high risk and those that routinely process high volumes of transactions. We Tranxact sets no upper limit for the amount your business can process through the account.

Round the clock assistance

Our long-established relationships with merchant service providers and merchant acquirers, as well as our buying power, help us secure preferential rates for you.

We aim to secure you the best deals from tested and approved card payment processors.

Take payments anywhere

We Tranxact experts are here to provide completely open, unbiased and honest advice and recommendations 24/7.

With us at your disposal, you attain complete peace of mind and obtain great services and competitive offers.

Custom solution

At We Tranxact, we understand that every business is different. Your business’s survival in the marketplace relies highly on the funds you obtain through selling your services. Hence, based on your requirement, we created a custom merchant account solution.

We are your trusted partner

Some of the clauses on the contract may come with hidden charges, but that doesn’t mean you cannot trust us.

Our experts are ever-ready to run you through every clause in-depth. We help you comprehend the contractual terms and conditions, and recommend you any potential downfalls and their suitable alternatives.

Industry knowledge

We Tranxact is one of the leading Merchant Account Providers in the UK. No matter what type of business you own, we can deliver custom products to help you gain an edge over your competitors. Whether you wish to get started or are already trading, We Tranxact can help you obtain the best settlement times and processing rates to ensure the payments aren’t hindering your business.

Frequently Asked Questions

Once you sign up with us to hold your merchant account, we will start receiving funds from your customers (irrespective of the mediums they use to pay you). The funds will get transferred to your bank account on a regular basis (typically daily).

Initially, you may require paying setup fees and then monthly fees on an every-transaction basis.

Keep in mind that merchant accounts can only obtain money transferred electronically.

A merchant account, alternatively, is a type of business banking product that makes it possible for your business to accept payments (through any medium) and obtain the funds directly through your website. Typically, your business bank should accept the funds but you can also go to an outside processing entity.

It is worth noting that merchant accounts aren’t deposited accounts that accumulate money. They are just pass-through accounts that provide a safe and secure root for money before it reflects in your bank account.

Once the transaction is authenticated by the card issuer after checking for fund availability and conducting security checks, the approval is sent to the merchant’s bank using the network processor. On approval, the merchant’s bank permits the transaction, and the fund settlement in the merchant’s bank account begins.

Other factors include –

- Their experience in the field

- Account approval rate

- Account approval timing (the lesser the better)

- Their relationship and links with all the major providers