Latest Trends in Payment Security: What Businesses Need to Know

Hey there, fellow business owners! If there’s one thing we can all agree on, it’s that payment security is absolutely essential in today’s digital world. With cyber threats constantly evolving, staying on top of the latest trends in payment security is crucial to protecting both your customers and your bottom line. So, buckle up and get ready to dive into the ever-changing landscape of payment security – because we’ve got all the need-to-know information right here. Let’s keep those transactions safe and secure, shall we?

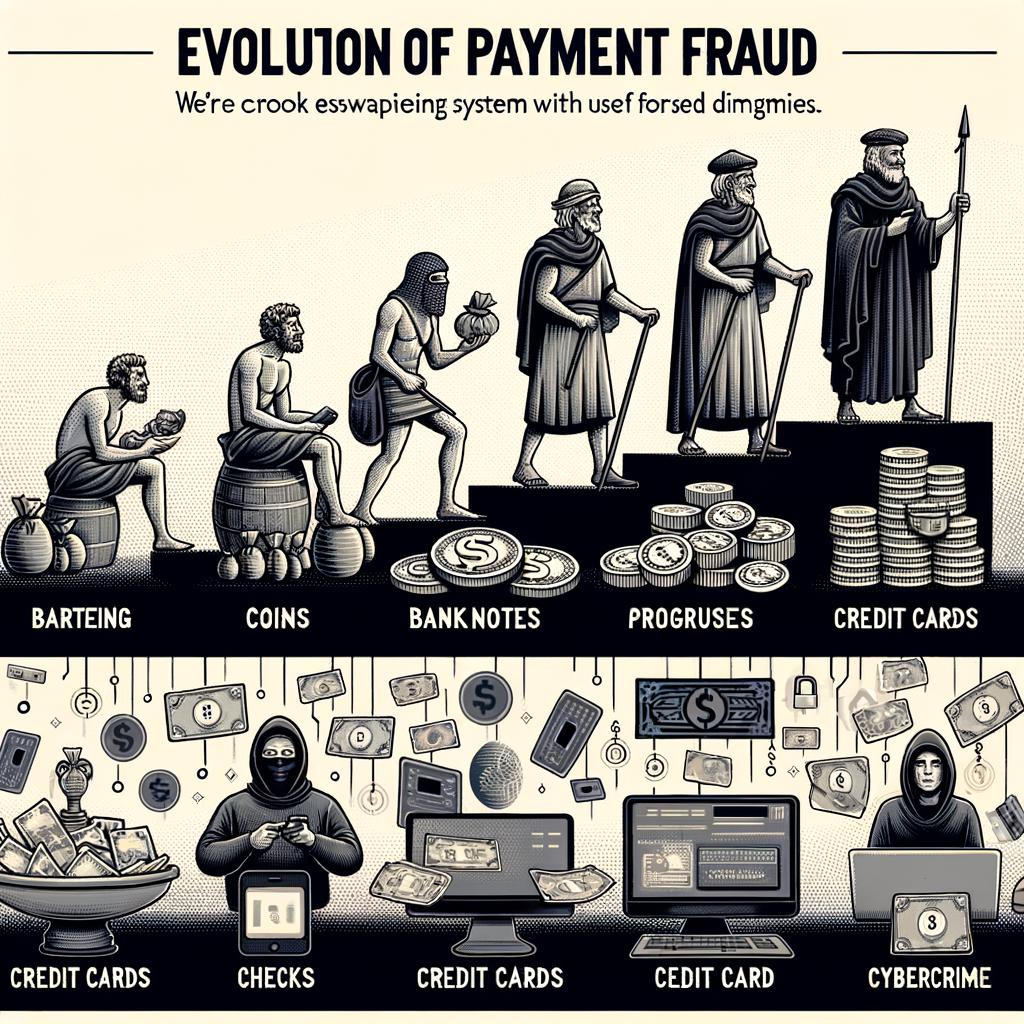

Understanding the Evolution of Payment Fraud

Overview: Payment fraud has been evolving rapidly in recent years, posing a significant threat to businesses of all sizes. As technology advances, so do the methods used by fraudsters to exploit vulnerabilities in payment systems. It is essential for businesses to stay informed about the latest trends in payment security to protect themselves and their customers.

Current Trends: Some of the latest trends in payment fraud include:

- Increasing sophistication of phishing scams targeting customer data

- Rise in account takeover fraud through stolen credentials

- Growth of e-skimming attacks on e-commerce websites

- Expansion of mobile payment fraud as more consumers use smartphones for transactions

Emerging Technologies to Enhance Payment Security

Businesses today are constantly adapting to the ever-evolving landscape of payment security. With the rise of online transactions and digital payments, staying ahead of the curve is crucial to protect sensitive customer information. Luckily, there are a number of emerging technologies that are revolutionizing the way businesses approach payment security.

One such technology is tokenization, which replaces sensitive payment data with a unique token that is useless to hackers. This helps reduce the risk of data breaches and ensures that customer information is protected throughout the payment process. Another breakthrough technology is biometric authentication, which uses fingerprints, facial recognition, or voice recognition to verify a customer’s identity. This adds an extra layer of security to transactions and makes it harder for unauthorized users to access payment information.

Best Practices for Businesses to Protect Against Cyber Threats

With the rise of online transactions, businesses need to stay up-to-date on the latest trends in payment security to protect against cyber threats. One important practice is to implement multi-factor authentication for all financial transactions. This extra layer of security can help prevent unauthorized access to sensitive payment information.

Another key practice is to regularly update security software and systems to patch any vulnerabilities that cyber attackers could exploit. This includes keeping firewalls, antivirus software, and encryption tools up to date. Additionally, businesses should provide regular training for employees on how to identify and respond to potential security threats. By staying proactive and vigilant, businesses can better protect themselves and their customers from cyber threats.

| Security Practice | Importance |

|---|---|

| Multi-factor authentication | Prevents unauthorized access |

| Regular software updates | Patches vulnerabilities |

| Employee training | Identifying and responding to threats |

Collaboration and Partnerships: The Key to Strengthening Payment Security

In today’s fast-paced digital landscape, ensuring payment security has become a top priority for businesses of all sizes. One of the key strategies to strengthen payment security is through collaboration and partnerships. By teaming up with industry experts, payment processors, and security firms, businesses can stay ahead of threats and keep customer data safe.

Here are some important trends in payment security that businesses need to be aware of:

- Tokenization: This process replaces sensitive payment information with a unique token, reducing the risk of data breaches.

- Biometric authentication: Utilizing fingerprints or facial recognition adds an extra layer of security to payment transactions.

- Blockchain technology: The decentralized nature of blockchain makes it a secure option for processing payments.

- EMV technology: Chip cards provide increased security compared to traditional magnetic stripe cards.

| Partner | Service Offered |

|---|---|

| XYZ Security Firm | Consulting on Payment Security Best Practices |

| ABC Payment Processor | Implementation of Tokenization Technology |

Final Thoughts

And there you have it, folks! The world of payment security is constantly evolving, and it’s crucial for businesses to stay ahead of the game. By keeping up with the latest trends and implementing the necessary measures, you can protect your customers and your business from potential threats. So, don’t wait - brush up on your knowledge, beef up your security protocols, and stay one step ahead of the cyber criminals. Your customers – and your bottom line – will thank you for it. Cheers to safe and secure transactions!