Understanding the Different Types of Global Payment Models

Imagine you’re at your favorite coffee shop in New York City, and you reach for your phone to pay for your latte. As you tap away on your payment app, you might not realize the complex global payment model that allows you to make that transaction seamlessly. From Bitcoin to contactless payments, there are a wide variety of payment models that power our increasingly cashless world. In this article, we’ll take a closer look at the different types of global payment models – so sit back, sip your coffee, and get ready to dive into the fascinating world of digital transactions.

Exploring the Landscape of Global Payment Models

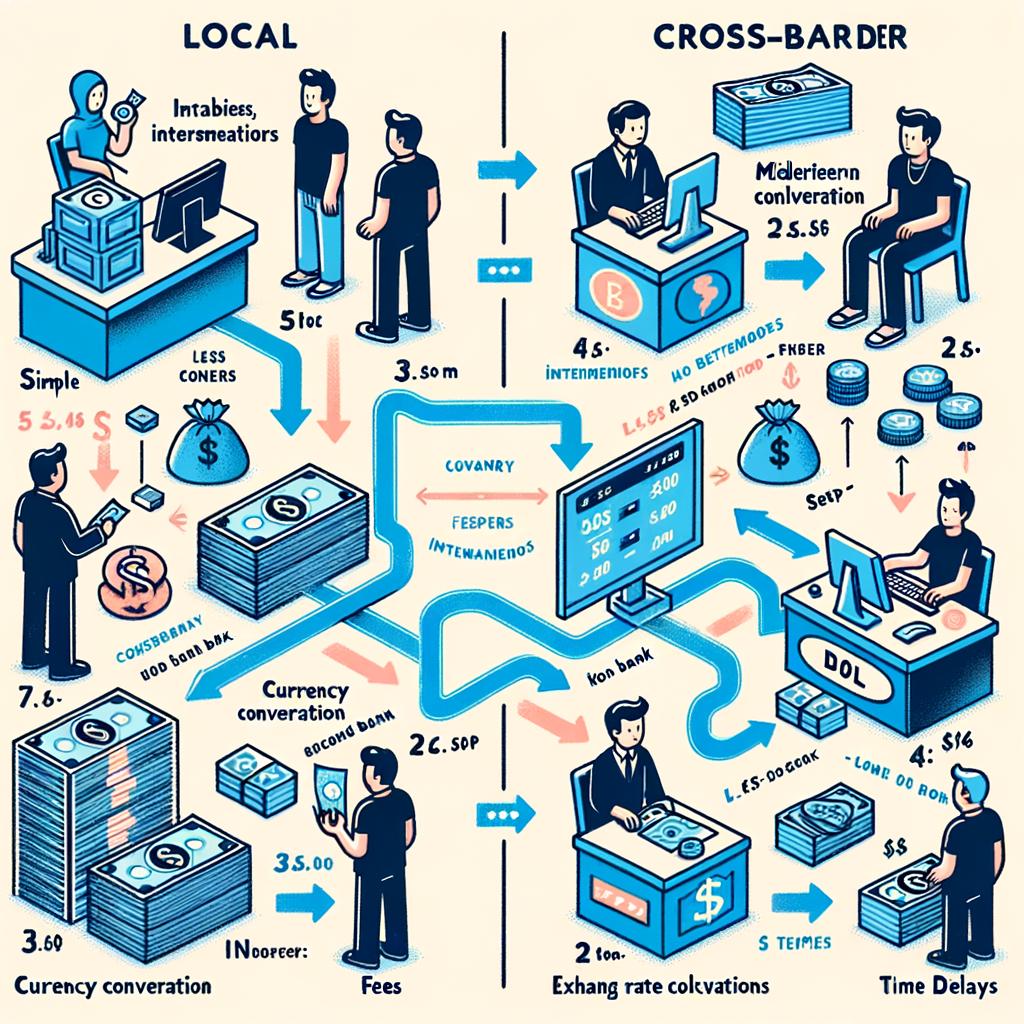

When it comes to global payment models, there are various types that businesses need to understand in order to navigate the complex landscape of international transactions. One common model is the cross-border payment model, which involves sending money from one country to another. This can be done through traditional wire transfers or newer digital payment platforms.

Another popular payment model is the subscription-based model, where customers pay a regular fee for access to a product or service. This can be seen in streaming services like Netflix or software companies like Adobe. Understanding the differences between these models is crucial for businesses looking to expand their reach globally and maximize their revenue streams. By choosing the right payment model for their needs, companies can ensure smooth transactions and happy customers worldwide.

Breaking Down the Differences Between Cross-Border Payments

When it comes to making payments across borders, there are various models that businesses can utilize to facilitate transactions efficiently. One of the common methods is SWIFT (Society for Worldwide Interbank Financial Telecommunication), which enables banks to securely communicate and transfer funds internationally. This approach is widely used for larger transactions due to its reliability and security protocols.

For smaller businesses or individuals looking for a more cost-effective option, peer-to-peer (P2P) platforms such as PayPal or TransferWise offer competitive exchange rates and lower fees compared to traditional banking methods. These platforms have gained popularity for their convenience and ease of use, making cross-border payments accessible to a wider audience. Whether you opt for SWIFT or P2P platforms, understanding the differences between these global payment models is crucial in choosing the most suitable option for your specific needs.

Choosing the Right Payment Model for Your Business

When it comes to , it’s important to understand the different types of global payment models available. Each model offers its own set of benefits and challenges, so finding the one that best fits your business needs is crucial. Here are some popular payment models to consider:

- Flat Rate: This model charges a fixed percentage or flat fee for every transaction, making it simple and predictable for businesses.

- Subscription: With this model, customers pay a recurring fee on a regular basis for access to products or services, providing a steady revenue stream for businesses.

- Pay-Per-Use: Customers are charged based on their usage of a product or service, allowing for flexibility and cost-effectiveness.

Recommendations for Optimizing Global Payment Processes

When it comes to global payment processes, it is crucial to understand the different types of payment models available. By optimizing these processes, businesses can streamline their transactions and improve efficiency. One popular payment model is the Direct Debit System, which allows businesses to automatically withdraw funds from a customer’s account on a prearranged schedule. This eliminates the need for manual payments and reduces the risk of late payments.

Another common global payment model is the Electronic Funds Transfer (EFT) system, which enables businesses to transfer funds electronically between different accounts. This method is secure, fast, and cost-effective, making it ideal for international transactions. To further enhance global payment processes, businesses can also consider using secure online payment gateways, such as PayPal or Stripe. These platforms offer secure payment processing options and help businesses expand their customer base worldwide.

In Summary

And there you have it – a deep dive into the fascinating world of global payment models. From subscription-based to transaction fees, understanding the different types can help you navigate the complex landscape of international payments. So next time you’re sending money across borders, you’ll know exactly which model suits your needs best. Stay savvy, stay global, and happy payments! Cheers!