Navigating International Card Processing: A Comprehensive Guide

Welcome to the ultimate guide on navigating the wild world of international card processing! Whether you’re a seasoned pro or just dipping your toes into the global commerce game, this comprehensive guide has got you covered. Sit back, relax, and get ready to learn everything you need to know about keeping those transactions flowing smoothly across borders. Let’s dive in!

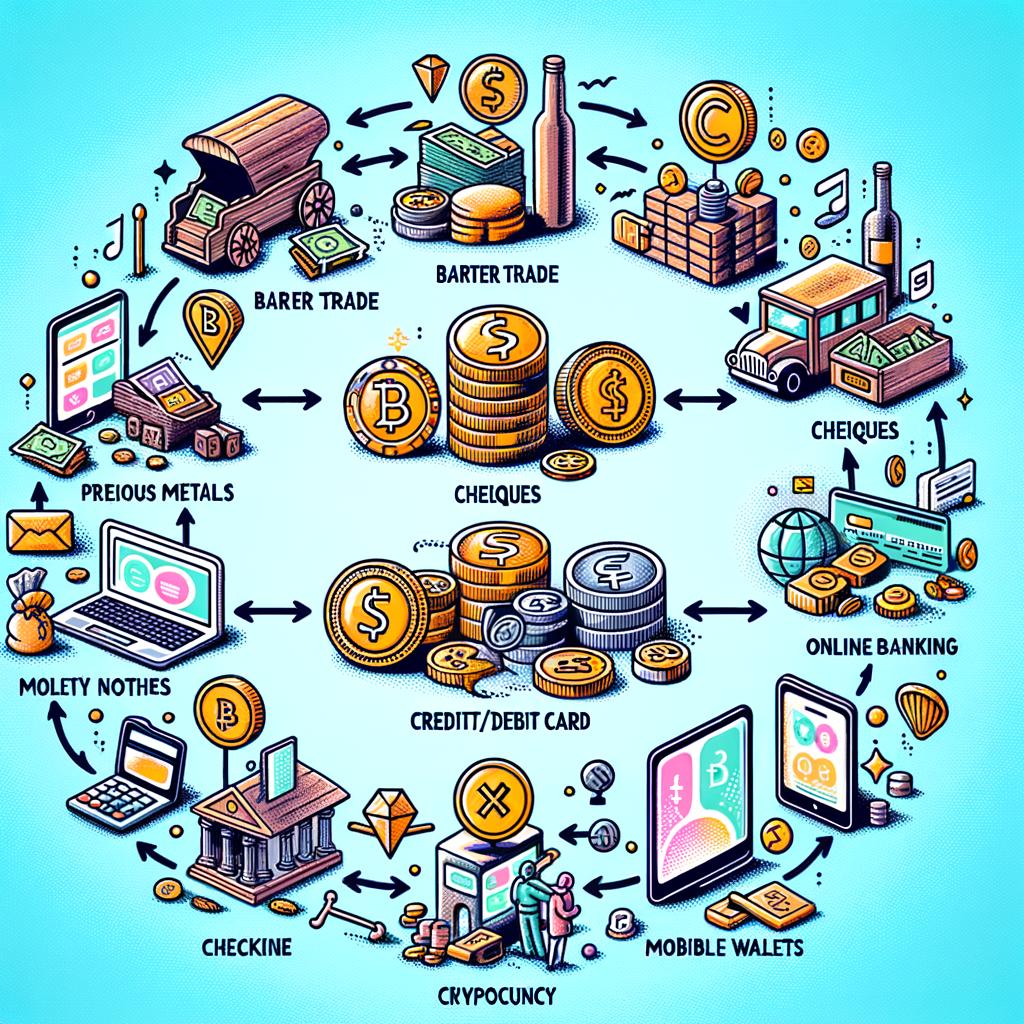

Understanding Different Payment Methods Around the World

When it comes to processing payments internationally, it’s essential to understand the different methods used around the world. One common method is credit card processing, which allows customers to make purchases using their credit cards. This method is widely accepted in many countries and provides a convenient way for customers to pay for goods and services.

Another popular payment method is digital wallets, such as PayPal, Apple Pay, and Google Pay. These platforms allow users to link their credit cards or bank accounts to make secure online payments. Digital wallets are gaining popularity globally due to their convenience and enhanced security features. Understanding these payment methods is crucial for businesses looking to expand internationally and cater to a diverse customer base.

Key Factors to Consider when Choosing an International Processing Partner

Consideration #1: Security and Compliance

When selecting an international processing partner, the first key factor to consider is their approach to security and compliance. Ensure that the partner is compliant with international data protection regulations such as GDPR and PCI DSS. Look for partners that offer secure encryption methods and have a solid track record of protecting sensitive cardholder information.

Additionally, inquire about their fraud prevention measures and risk management protocols. A reliable processing partner should have robust security measures in place to safeguard against fraudulent activities and protect both your business and your customers.

Consideration #2: Processing Fees and Rates

Another important factor to take into account is the processing fees and rates offered by the international partner. Compare the fee structures of different processors to find the most cost-effective solution for your business. Consider factors such as transaction fees, monthly minimums, chargeback fees, and currency conversion rates.

It’s also crucial to understand any hidden fees or additional charges that may apply. Choose a partner that offers transparent pricing and competitive rates to help optimize your international card processing operations.

Tips for Ensuring Compliance with Global Card Processing Regulations

When it comes to navigating the complex world of global card processing, ensuring compliance with international regulations is key to avoiding costly fines and penalties. To help you stay on top of things, here are some tips to consider:

- Stay Informed: Keep up-to-date with the latest changes in global card processing regulations by subscribing to industry newsletters and attending relevant webinars or conferences.

- Regularly Audit: Conduct regular audits of your card processing systems and procedures to identify any potential areas of non-compliance and address them promptly.

- Implement Secure Technologies: Utilize secure payment technologies, such as tokenization and encryption, to protect sensitive cardholder data and ensure compliance with data security standards like PCI DSS.

| Country | Regulatory Body |

|---|---|

| United States | PCI Security Standards Council |

| European Union | Payment Services Directive (PSD2) |

Maximizing Security and Fraud Prevention in International Transactions

When it comes to international transactions, ensuring maximum security and fraud prevention is crucial. One way to enhance security is by implementing tokenization technology for card processing. This process replaces sensitive card information with a unique token, reducing the risk of fraud during online transactions. Additionally, utilizing 3D Secure authentication protocols can add an extra layer of security by requiring customers to verify their identity with a password or biometric data.

Another effective strategy for maximizing security in international transactions is to partner with a reputable payment gateway that offers advanced fraud prevention tools. These tools can help detect and prevent suspicious transactions before they are processed, reducing the risk of chargebacks and financial losses. Additionally, staying informed about the latest fraud trends and prevention techniques can help merchants stay ahead of potential threats and protect their customers’ sensitive information.

To Conclude

And that’s a wrap on our comprehensive guide to navigating international card processing! We hope you now feel equipped to confidently explore global markets and easily accept payments from customers all around the world. Remember, the world is your oyster, so don’t let borders hold you back from expanding your business and reaching new audiences. Cheers to seamless transactions and successful ventures abroad! Happy processing!